The GCC is set to defy a sluggish global economic forecast, with projected growth nearly doubling this year, according to the latest Institute of Chartered Accountants in England and Wales (ICAEW) Economic Insight Q3 2025 report, produced by Oxford Economics.

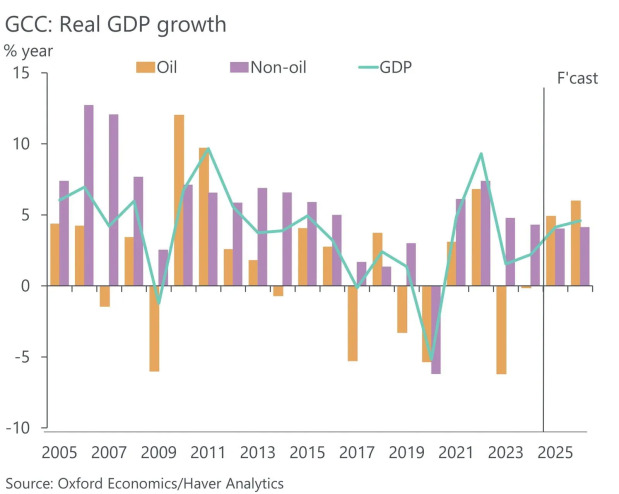

While global GDP growth is expected to hit its lowest point since 2020 at 2.7 per cent, the GCC region is on track for a robust 4.1pc expansion this year before accelerating to 4.6pc in 2026.

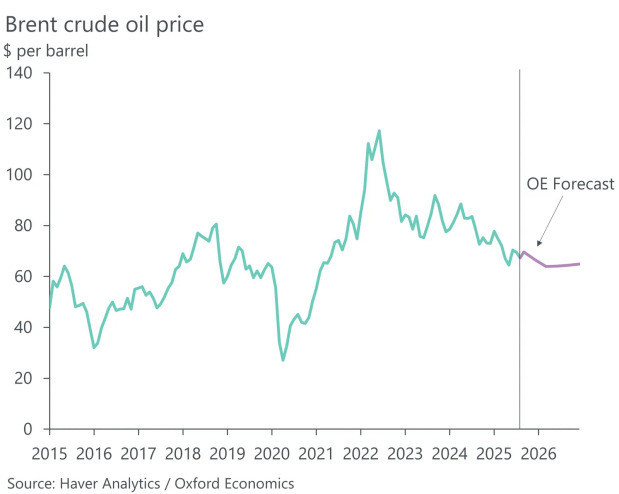

This positive outlook is primarily driven by a faster-than-expected increase in oil production by Opec+ members.

The report notes that Opec+ began to unwind production cuts ahead of schedule in April, and plans to restore nearly 2.5 million barrels per day by the end of October.

The sharp increase in oil production has lifted energy sector growth forecasts to 4.9pc in 2025 and 6pc in 2026.

This move is expected to significantly boost the energy sectors of Saudi Arabia and the UAE, where most of the group’s spare capacity is located.

Non-oil sectors are also showing strong momentum.

Driven by healthy job markets and high consumer confidence, non-energy output across the GCC is expected to grow by 4pc this year.

Non-oil exports from Saudi Arabia and the UAE have seen a significant increase, showcasing the region’s resilience to global trade tensions and progress toward diversification goals.

The UAE economy is set to grow 5.1pc in 2025, with non-oil GDP rising 4.7pc, now accounting for 77pc of total GDP.

Meanwhile, Saudi Arabia is forecast to expand 4.2pc, with non-oil sectors sustaining annual growth of around 5pc, driven by construction, trade, and financial services.

Despite geopolitical tensions and fluctuating oil prices, the region’s tourism sector continues to thrive, contributing to non-oil growth and fiscal revenues.

Dubai, for example, welcomed nearly 10m visitors in the first half of the year, a 6pc increase from the same period last year.

In other developments, the report anticipates the US Federal Reserve will begin cutting interest rates this month, a move expected to support consumption and investment in the GCC, as the region’s central banks typically follow US monetary policy.

Although the report projects a budget deficit for Saudi Arabia this year at 3.6pc of GDP, it notes that the fiscal health of the GCC’s largest economy remains strong, with non-oil revenues growing and government spending becoming more disciplined. Kuwait, Bahrain, and Oman are also expected to run deficits, while Qatar and the UAE are projected to maintain surpluses.

ICAEW head of Middle East Hanadi Khalife said: “The GCC economies are showing that diversification is more than policy.

It is a measurable driver of resilience. With non-oil sectors powering growth momentum in Saudi Arabia and accounting for the majority of GDP in the UAE, alongside fiscal reforms in Kuwait, the region is successfully turning global challenges into opportunities for transformation.”

According to ICAEW economic adviser and Oxford Economics Middle East chief economist and managing director Scott Livermore, the GCC is not only recovering from oil production cuts; it is reshaping its growth model.

“While Kuwait’s fiscal reforms and Qatar’s LNG expansion provide confidence in the medium term, recent geopolitical escalations involving Qatar, and Gulf leaders’ recognition of its right to respond, add some uncertainty to the near-term outlook. Even so, the region’s mix of reforms, energy growth, and strong non-oil diversification positions it to outperform global peers,” he added.

avinash@gdnmedia.bh

&uuid=(email))