The GCC continues to be a prime destination for global investors, according to Kearney’s 2025 Foreign Direct Investment Confidence Index (FDICI).

The survey, conducted in January 2025, highlights the enduring appeal of the region, with the UAE leading the pack, securing the ninth global rank and second position among emerging markets, reaffirming its status as the GCC’s investment hub.

Saudi Arabia closely follows, climbing to 13th place globally and maintaining its third position within emerging markets. Notably, Kuwait has made its debut on the Emerging Markets Index, ranking 18th – a clear indication of increasing investor confidence across the Gulf.

The 27th edition of the FDICI offers a forward-looking perspective on FDI flows by surveying global business leaders about their most likely investment destinations over the next three years.

The Index captures investor sentiment amidst a dynamic global environment. The GCC’s strong performance is attributed to a long-term economic vision, consistent regulatory reforms, and targeted national strategies aimed at attracting high-value investments across diverse sectors.

Investor interest in the region is substantiated by compelling data. In the UAE, the digital economy is projected to contribute more than 20 per cent to GDP by 2031, supported by national strategies and significant infrastructure projects such as Etihad Rail and the expansion of data centre capacity. Foreign Direct Investment (FDI) inflows into Saudi Arabia’s non-oil sector saw a 10.4pc increase in 2023, while its ambitious $100 billion AI-focused ‘Project Transcendence’ is positioning the kingdom as a regional technology powerhouse.

Kuwait also witnessed a more than doubling of FDI inflows in 2023, reaching $2 billion, driven by targeted investment incentives, improvements in the ease of doing business, and a broader diversification push under its Vision 2035.

The 2025 Index provides insights into the key factors influencing investor decisions in the GCC. The primary reasons for investing in the region include strong domestic economic performance, ease of doing business, technological innovation, and access to natural resources.

These drivers align with the region’s ongoing reform agendas – from the UAE’s pro-technology, low-tax business environment to Saudi Arabia’s streamlined investment laws and burgeoning innovation ecosystem, and Kuwait’s reforms enabling foreign firms to operate without local sponsors in priority sectors like Information and Communication Technology (ICT), healthcare and renewables.

On a broader global scale, the UAE, Saudi Arabia, and Kuwait stand out among emerging markets, alongside China, as top destinations for FDI in the coming three years.

Rudolph Lohmeyer, senior partner of Global Business Policy Council and head of the National Transformations Institute, part of Kearney Foresight Network, said, “In a global climate marked by uncertainty and policy shifts, the GCC’s ability to maintain investor momentum is no accident. It stems from consistent vision, bold reform, and a clear commitment to economic transformation. Investors today are looking not only for opportunity but for clarity and resilience. The Gulf delivers both.”

Investor sentiment for the year was captured prior to the recent escalation of trade tensions in early April. However, early indicators already pointed to increased investor concern regarding global instability, with rising commodity prices and geopolitical tensions being key anticipated developments. Nevertheless, amidst this uncertainty, investors continue to prioritise strong fundamentals when selecting markets, citing legal and regulatory efficiency, economic performance, and innovation as crucial drivers.

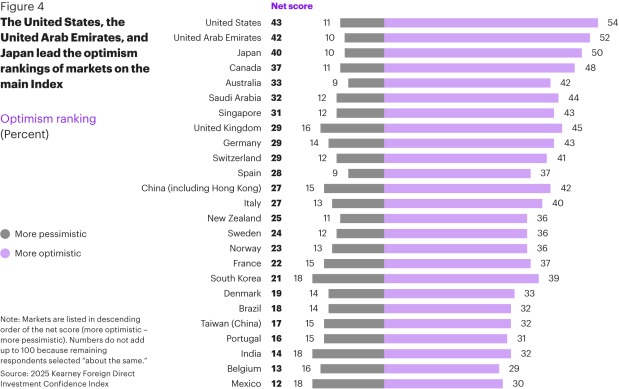

“While the Middle East sees strong representation, developed markets dominate the global rankings, led by the US,” added report co-author Erik R Peterson, partner and managing director of Kearney’s Global Business Policy Council.

“This speaks to a dynamic and evolving investment landscape, where investors are not only weighing opportunity but also navigating rising risks, including increasingly restrictive regulatory environments driven by a wave of industrial policy aimed at strengthening domestic resilience and national security.”

avinash@gdnmedia.bh

&uuid=(email))