Foreign capital continued to flood into GCC stock markets in the third quarter of 2025, with institutional and retail investors making net purchases of $4.8 billion, up from $4.2bn in the previous quarter.

Analysis by Kuwait-based Kamco Invest shows this sustained buying spree pushed year-to-date (9M-2025) foreign inflows to $11.7bn, a jump of 35.4 per cent year-on-year from the $8.6bn recorded in 9M-2024.

Saudi Arabia attracted the largest quarterly net foreign buying at $2.8bn. The UAE followed, with consecutive buying on its exchanges: Abu Dhabi saw $798.7 million in net buys, and Dubai recorded $614.9m.

Crucially for the local market, Bahrain maintained a positive trend, logging $22.9m in net buying from foreign investors during Q3-2025.

Oman was the only market to see outflows for the second quarter in a row, with net sales of $38.7m.

For the nine-month period, the UAE was the biggest recipient of foreign capital at $5.9bn, followed by Saudi Arabia at $4.5bn.

The regional sentiment was overwhelmingly positive, with the MSCI GCC Index rising 4.6pc in Q3-2025 – its strongest quarterly performance in three years.

Oman led the rally with a 15.1pc gain, making it the quarter’s top-performing GCC market.

Kuwait was up 4pc, while Saudi Arabia and Qatar recorded gains of 3pc and 2.8pc, respectively.

The Bahrain Bourse also posted a modest gain of 0.2pc.

Market attractiveness is set to improve further as Saudi Arabia’s Capital Market Authority (CMA) recently moved to lift the foreign ownership cap in Saudi-listed companies beyond the 49pc limit, potentially allowing full foreign ownership in main market listings before the end of the year.

While foreign investors were net buyers, GCC investors (excluding Bahrain, due to data unavailability) were net sellers during Q3-2025, recording $51.2m in net sales. However, local GCC investors did show buying in certain markets, with Saudi Arabia seeing the biggest net purchase at $121.8m, followed by Qatar at $62.6m.

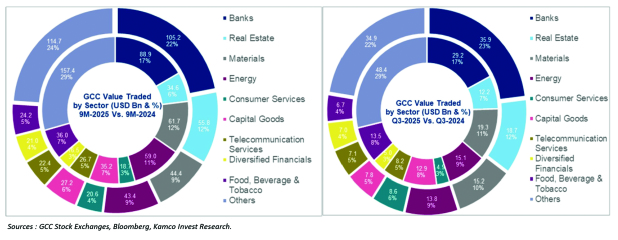

Total GCC trading volume increased by 15pc quarter-on-quarter to 108.9bn shares, with Kuwait leading the surge with a 38.2pc gain. The banking sector dominated value traded, accounting for $35.9bn in Q3-2025.

avinash@gdnmedia.bh

&uuid=(email))